This proposal is in direct response to President Biden’s call to aims to remedy and redress our nation’s and the federal government’s history of discriminatory housing practices and policies, which directs HUD to implement the Fair Housing Act’s requirement to AFFH.

Whereas HUD dropped the ball on fair housing, the SBA was created to assist small businesses in four main areas: financing, education and training, government contracting, and providing a voice in policy matters. These programs are still aimed at helping entrepreneurs start their businesses and keep them thriving.In particular, the proposed rule is designed to simplify the required fair housing analysis, emphasize goal-setting, increase transparency for public review and comment, foster local commitment to addressing fair housing issues, enhance HUD technical assistance to local communities, and provide mechanisms for regular program evaluation and greater accountability, among other changes.

Under the proposed rule, program participants every five years would submit to HUD for review and acceptance an Equity Plan. That plan, which must be developed following robust community engagement, would contain their analysis of fair housing issues confronting their communities, goals, and strategies to remedy those issues in concrete ways, and a description of community engagement. The proposed rule would then require program participants to incorporate goals and strategies from their accepted Equity Plans into subsequent planning documents (e.g., Consolidated Plans, Annual Action Plans, and Public Housing Agency Plans).

Lenders who participate in the U.S. Small Business Administration’s Preferred Lender Program can approve loans through the agency’s new Small Loan Advantage program. At the same time, the agency will begin accepting applications from community-based, mission-focused lenders who are interested in making SBA-guaranteed loans through the new Community Advantage program.

Born in 1880, Anderson Hunt Brown used his natural business genius to become one of the nation’s first Black property moguls—and he used his wealth to effect serious advances for civil rights.

Both the Small Loan Advantage and Community Advantage programs were announced in December as part of the agency’s efforts to increase the number of lower dollar loans being made to small businesses and entrepreneurs in underserved communities.

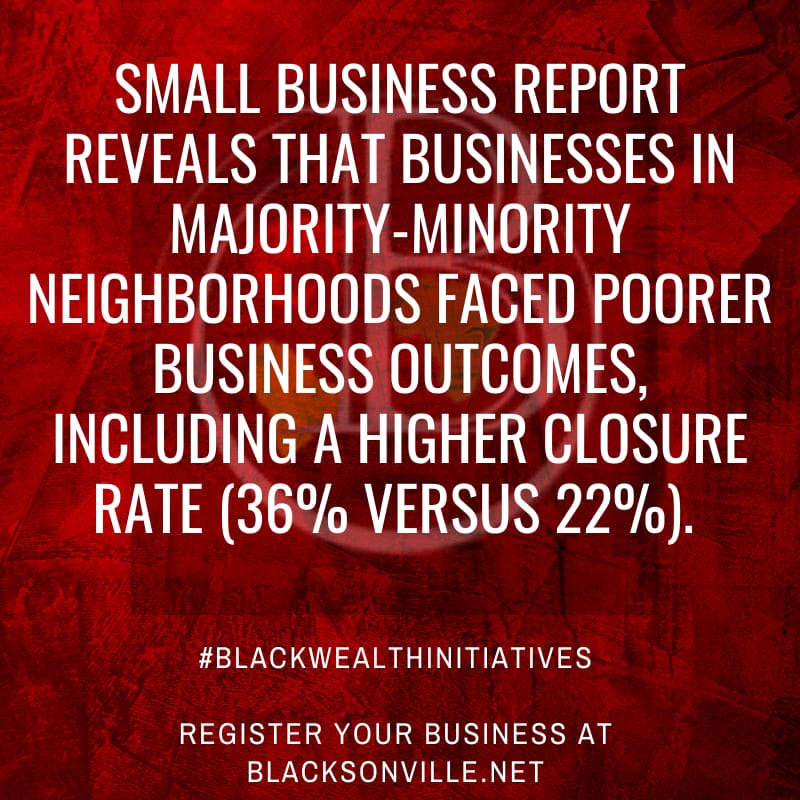

“Businesses in underserved communities, including minority and women-owned as well as businesses in rural areas, have been among the hardest hit by the recent economic downturn,” said SBA Administrator Karen Mills. “These two new Advantage initiatives can provide critical support to help these businesses and entrepreneurs get much needed financing to start and grow, which will translate into more jobs in these communities.”

Built on what the agency refers to as its “Advantage” platform, both Small Loan Advantage and Community Advantage offer a streamlined application process for SBA-guaranteed 7(a) loans up to $250,000. Advantage loans will come with the regular 7(a) government guarantee, 85 percent for loans up to $150,000 and 75 percent for those greater than $150,000.

Any of the 610 financial institutions across the country in the SBA’s Preferred Lender Program (PLP) can approve loans using the new Small Loan Advantage process. Under PLP, which includes most of the agency’s highest volume lenders, SBA delegates the final credit decisions to these lenders.

In 2021, the SBA began accepting applications from financial institutions who are interested in becoming Community Advantage lenders. Through Community Advantage, the agency will expand the points of access small business owners have for getting loans by opening SBA’s 7(a) loan program to “mission-focused” financial institutions, including Community Development Financial Institutions, SBA’s Certified Development Companies and SBA’s nonprofit micro-lending intermediaries. Community Advantage will leverage the experience these institutions already have in lending to minority, women-owned and start-up companies in economically challenged markets, along with their management and technical assistance expertise, to help make their borrowers successful.

SBA and U.S. Department of Commerce studies have shown the importance of lower-dollar loans to small business formation and growth in underserved communities. With that in mind, the two new loan initiatives – Small Loan Advantage and Community Advantage – are aimed at increasing the number of lower-dollar SBA 7(a) loans going to small businesses and entrepreneurs in underserved communities. The agency’s most popular loan product, 7(a) government-guaranteed loans can be used for a variety of general business purposes, including working capital and purchases of equipment and real estate.

Community-based organizations interested in becoming Community Advantage lenders should contact the closest SBA district office.