The black business report, which is titled “Repairing the Cracks: How New Jersey Can Restore Black & Brown Communities Ravaged by COVID-19 and Systemic Racism,” explores the impact the pandemic has had on Black and other minority communities in the Garden State and proposes policies designed to address the harm caused by the public health crisis.

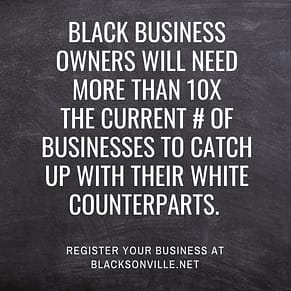

Black-owned small businesses represent 9.5% of all small businesses in the United States (around 2.6 million). Georgia and Florida are among the top 4 states with the most black-owned small businesses, and these are major markets in the Southeast Region. Much of the American Rescue Plan Act has been delivered through programs administered by the U.S. Small Business Administration (SBA).

As of December 2022, over $1.4B in PPP loans were paid to wealthiest law and accounting firms (watchdog uncovers). Among these firms, Black-owned businesses were much more likely to obtain their PPP loan from a non-relationship fintech lender, and much less likely to obtain it from a non-relationship small bank.

“We want people to recognize that these disproportionate impacts are the results of policy, and to avoid these same disproportionate impacts in the next crisis, whether it’s a pandemic or a different type of crisis, we need to move forward with policies that intentionally promote equity,’’ Sullivan said. “We have a cracked foundation, and we need to rebuild that foundation intentionally with policies that promote inclusion and equity instead of reenforcing long-lasting disparities.”

New figures show how deadly COVID-19 is for Blacks, Hispanics, Asians in NJ

The 24-page report addresses immediate and short-term needs of vulnerable residents in the state, including the prioritization of equitable COVID-19 vaccine distribution, protecting those facing evictions and foreclosures, supporting young people returning home from youth facilities due to the pandemic, and expanding access to wealth through home ownership. The report also calls on New Jersey to establish a guaranteed income program, a New Jersey Reparations Task Force and for the state to close youth prisons and fund community-based systems of care for troubled youths.According to the Stanford Institute for Economic Policy Research, the pandemic contributed to tipping 41% of Black-owned US businesses into closure from February to April 2020. Of the businesses that survived the pandemic, 8.8% black-owned businesses reported profitability and growth according to a SCORE.org study. This data leads to the question: which response strategies did black-owned businesses use to survive the pandemic? The answer is clear through data collected through a SCORE.org survey. According to the study, 53.4% of Black-owned businesses applied for federal recovery funding, and 20.3% received the full amount that was applied for.

The top industries represented by black-owned business in the U.S. include Accommodation and Food Services, Construction, Health Care and Social Assistance, Professional, Scientific, Technical Services, and Other Services (except Public Administration), and Manufacturing. These industries align with the top funded industries through the Paycheck Protection Program (PPP) reflecting that black-owned businesses gained some traction in utilizing the PPP.

Healthy Black-owned businesses could be a critical component for closing the United States’ Black–white equity gap. The SBA has strived and continues to strive to lessen this gap through opportunities made available to small businesses, especially in underserved areas. Other than the recovery programs administered through SBA (PPP, EIDL, SVOG, RRF, CNPP, etc.), the SBA has positioned itself in communities to be a key resource to the black business community.

List your business in the black directory to help add value to our global community network.

One effort that the SBA has made in terms of servicing the black-owned business community is through the Women’s Business Centers. Five of the 136 centers across the United States are collocated with Historically Black Colleges and Universities (HBCU’s) located in the Southeast. Also, 18 Small Business Development Centers are hosted by HBCU’s; 8 of them located in the Southeast. Overall, black small business owners are younger and include more women than the general small business population. According to The State of African American Owned Businesses by SCORE.org, 22% of African American small business owners are millennials, nearly twice as many as the 12% of millennial small business owners in the general population. With this data in mind, SBA is clearly investing in America’s youth.

Black-owned businesses have also responded to the pandemic through use of SBA’s traditional 7(a) and 504 Loans. So far across the Southeast Region in FY 2021 (ending September 30), there is already an increase of 53 loans over the full fiscal year of FY 2020 valued at an increase of $58 million and this number can only continue to increase as the fiscal year end nears.

On the federal government contracting side, Black-owned small businesses should be determined, posture, and anchor themselves to be full participants in the world’s largest marketplace. If eligible and not yet certified, apply for certifications including 8(a), HUBZone, WOSB and EDWOSB, etc. Federal contract awards from this source can add an additional stream of income enhancing your business development and growth.

To ensure Black Business Recovery nationwide is both equitable and reparative, BIPOC communities should do the following:

1. Address the immediate short-term needs of vulnerable residents:

-

-

- Prioritize equitable vaccine administration and distribution

- Protect local BIPOC from eviction and foreclosure

- Support young people returning home from youth facilities due to the pandemic

-

2. Establish a local Reparations Task Force

3. Create a statewide guaranteed income program

4. Expand access to wealth through homeownership in divested communities of color

5. Close youth prisons and meaningfully fund a youth community-based system of care

6. Eliminate barriers to voting by passing same-day voter registration

In honor of Black Business Month this September 2021 and during Black History Month 2022, it is important to me to capture the overall health of the black business community and to understand the response strategy of black-owned small businesses. This is a time that is critical for communities to work together, blend resources, and support one another for continued business survival and growth.